Many practices are seeing increases in self-pay patients, often because they have a high-deductible or other plan that requires significant out-of-pocket payments. The increase in these high-deductible patients is directly related to the headache levels of the front office and billing staff.

Most insured patients with “traditional” insurance are required to pay something, either a $20 to $35 copay or a percentage of the bill. The IRS defines a high-deductible health plan as one that has higher annual deductibles than typical health plans and a maximum limit for out-of-pocket expenses (including deductibles but not including premiums). Patients with high-deductible health plans could owe the entire bill at the time of service, including diagnostic testing, procedures, and medications.

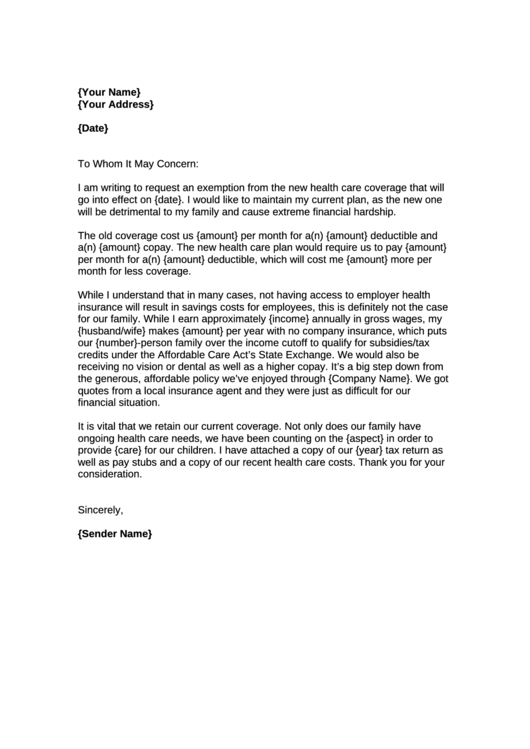

Template letter notifying patients/families with insurance that includes high out-of-pocket expenses (deductibles and co-pays) about the practice’s financial policies. Outstanding Patient Account Balance Letter. Template letter to patients/families alerting them of an outstanding patient account balance. Families Without Health Insurance. In-hospital care 30% after deductible 20% after deductible Emergency Room 30% after deductible 20% after deductible and $250 Copay Office Visits $30 primary care Dr.; $45 specialist $25/visit plus 20% Standard Lab/X-Rays In Dr ofc, no charge 20% after deductible High Technology Lab/X-ray 30% after deductible 20% after deductible.

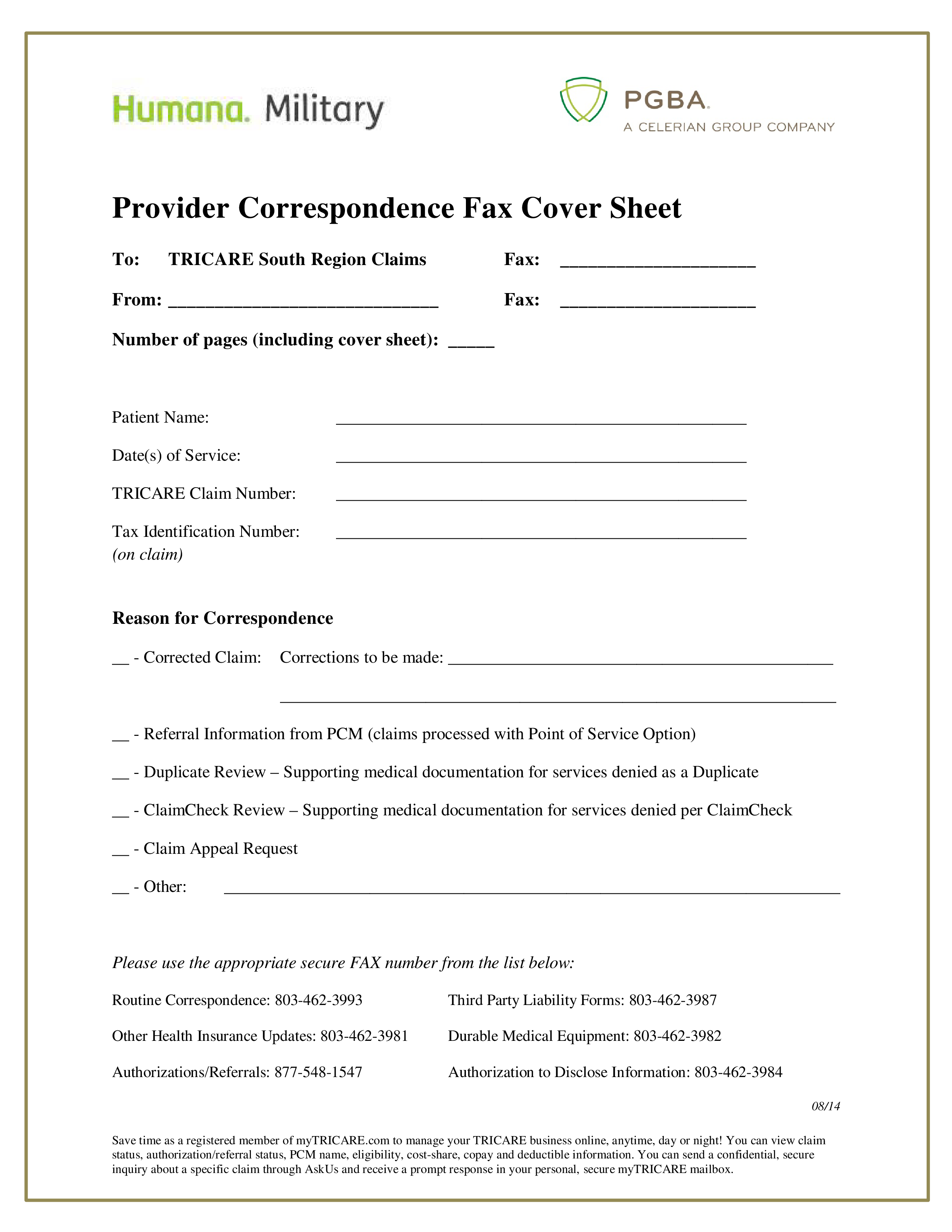

Many patients simply don’t realize that doctors have no control over whether or not a patient must pay a copay, deductible or co-insurance. It is annoying when you are later sent a $90 bill just for a ten minute checkup and urine sample though on top of the copay. Insurance is a scam. The only gauranteed payment is the co pay you are. Your health insurance plan has a deductible of $5,000 with $10 copays for doctor visit and $5 copays for prescription medications. You've already paid $4,000 towards your deductible for the. Coverage Administration (i.e. Copay, deductible, etc.) 11.Maximum Reimbursable Amount. 12.Inpatient Facility Denial (Level of Care, Length of Stay). Based on medical necessity and other common administrative denials and supporting documentation and keep claim appeal letter templates that will help simplify your appeals process.

High-deductible health plans are increasing in the individual as well as in the employer market, and most of the Affordable Care Act's Marketplace plan enrollees are in plans that are considered high-deductible. According to the February 2016 Consumer Reports, “This year, 86 percent of employers will offer high deductible plans as an option, up from 54 percent five years ago. .. Enrollment has more than doubled from 20 percent to 43 percent over the past five years.”

Patients may choose plans with lower premiums, but when faced with paying for their health care at the time of service, they often find they cannot afford to pay the high deductible. While some preventive services are covered, all medical care must be paid for until the deductible is met. This is a problem for the front desk and billing staff in the medical practice, because asking patients to pay for their care at the time of service is not always an easy task. Playstation remote play amazon fire stick. However, there are steps a practice can take to make the process run more smoothly.

Set expectations. Review the practice's financial responsibility form and new patient letter. Are they clear, yet short enough that patients will read and understand them? Require payment for all co-insurance and deductibles at the time of service. Repeat these expectations at scheduling and when reminding about the appointment, then reconfirm at check-in. It's one thing to pay for a simple visit, but for visits with more expensive services, such as tests and procedures, consider allowing a minimum payment amount, such as 50%, at the time of service if the patient is willing to set up a payment plan before leaving the office. Some practices offer “prompt payment” discounts to patients, but this sometimes ends up discounting a service twice, once to the patient and again to the insurance plan, which also pays less than full charges.

Verify eligibility and benefits. This is very important. Practices should know where patients stand in their deductibles and what is covered before they walk through the door. For example, some high-deductible health plans exempt certain preventive care services from the deductible. Scheduling staff should be trained to get as much information as possible so they can find out what exactly is covered before patients come in for their appointment.

Have multiple options for payment, and make sure staff knows how to use them. Train your staff on how to ask for payment firmly but politely. There will always be patients who have myriad reasons not to pay, but collection chances decline dramatically if the patient leaves without paying. Remember that the transaction costs for credit card payments are far less than the costs required to bill the patient and work the accounts receivable.

Deductible Letter To Patient

Many practices are requesting that patients keep a credit card on file as a convenient way to pay monthly or even occasional copayments. This can save the practice a lot of collection time and effort. However, it is important to have clear policies and authorizations about when signatures are required, when a card will be charged, how and if receipts will be issued, and how refunds will be handled. Compliance with all federal, state, and local laws related to credit card security is a given. For example, the Federal Trade Commission Safeguards Rule requires all businesses to protect customer information. It is best not to keep this information in paper form in the office but to use a secure system to store and transmit it. Check with your credit card vendor or your practice management system vendor for possible options.

For more collection tips, including customizable sample policies, letters, forms, and scripts for use in your office, see ACP's Billing and Collection Manual online .

Copay And Deductible Template Letter Template

Margo Williams, MHA, CMPE, is a senior associate in ACP's Department of Medical Practice, which provides ACP members with resources related to practice management, compliance, and health information technology.